Blog

What’s holding back growth for UK plc?

09 February 2026

British business had lots to celebrate in 2025, from Octopus Energy, Britain’s Most Admired Company, to Rolls-Royce under Britain’s Most Admired Leader, Tufan Erginbilgiç.

But despite record FTSE highs, the CBI describes the ‘mood music’ for growth in 2026 as “more ‘cautious optimism' than 'cause for celebration'."

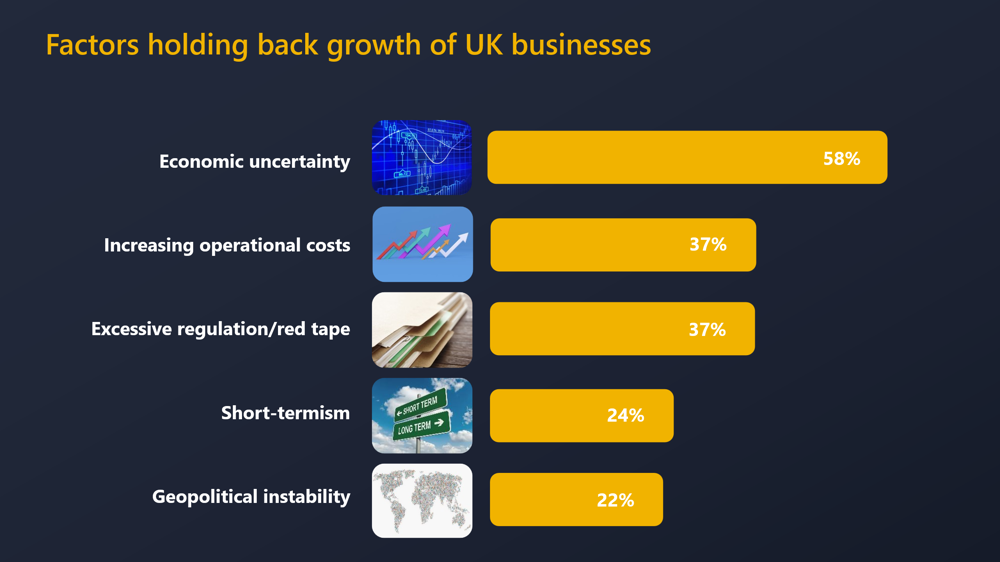

To understand what’s holding back business growth, Echo Research analysed more than 130 verbatim responses from C-Suite business executives, as part of our 2025 Britain’s Most Admired Companies survey.

1. Economic uncertainty.

A volatile operating environment makes forward-planning trickier, stifling investment as businesses hunker down in wait-and-see mode.

“Ever since the mini-budget of 2022, the economy has been a brake on performance.”

As Andy Haldane, formerly Chief Economist at the Bank of England has said, “growth is not constrained by a lack of ideas, but by a lack of confidence to act on them.”

2. Rising operational costs.

High employer National Insurance, business rates and energy prices are seen to be steadily eroding competitiveness and reducing the incentive to locate capital-intensive activity in the UK.

“The energy costs are crippling and are really impacting profits and growth.”

3. Red tape: the “cumulative burden of over-regulation”.

“A boot on the neck of business, choking off the enterprise and innovation that is the lifeblood of growth” as the Chancellor, Rachel Reeves, put it in her Mansion House speech.

“By way of example” said one respondent, "the forthcoming Employment Bill will inevitably hinder growth, reduce job opportunities (as companies will be reluctant to take on new hires), increase costs and make individual companies and the UK as a whole more uncompetitive”.

4. Short-termism.

Political and market time horizons are misaligned with long-cycle investment in future skills, infrastructure and tech.

“If the country were a PLC, what would its strategy be; and where would we be investing for long-term growth?”

5. Geopolitical volatility

This compounds domestic uncertainty. Trade friction, talent mobility and capital market competitiveness all shape strategic decisions. Businesses are not seeking insulation from global risk, but clarity about how the UK intends to navigate it.

These constraints on growth are structural and cumulative but, crucially, business leaders don’t see them as insoluble.

In our companion article, we look at the policy changes which business leaders believe would unlock growth for UK plc.